Managing personal finances can sometimes feel like unraveling a complicated puzzle, but this is where the assistance of a financial advisor becomes crucial.

If you are considering beginning your investment journey, preparing for retirement, or managing your debt, a financial advisor can serve as a reliable and knowledgeable guide to assist you in navigating the intricacies of personal finances. In this article, we will outline five essential steps to help you select the right financial advisor for your needs.

We will discuss their functions, their pricing structure, and the insightful inquiries to pose in order to assist you in making informed decisions regarding your finances.

1. Gain a comprehensive understanding of your financial objectives.

Prior to commencing your search for a financial advisor, it is imperative to ascertain your financial objectives and requirements. It is essential to articulate the specific areas in which you require assistance when you initially engage with a prospective advisor. Financial advisors possess expertise in various aspects of financial planning, hence having a clear understanding of your needs can assist in streamlining your search process.

Perhaps you require assistance with immediate requirements such as setting aside funds for a vacation, settling a credit card balance, or merging your debts. Alternatively, you might seek guidance in fields like planning for retirement, constructing an investment portfolio, or managing your long-term wealth.

This level of clarity will assist you in locating a proficient financial advisor who aligns with your specific requirements.

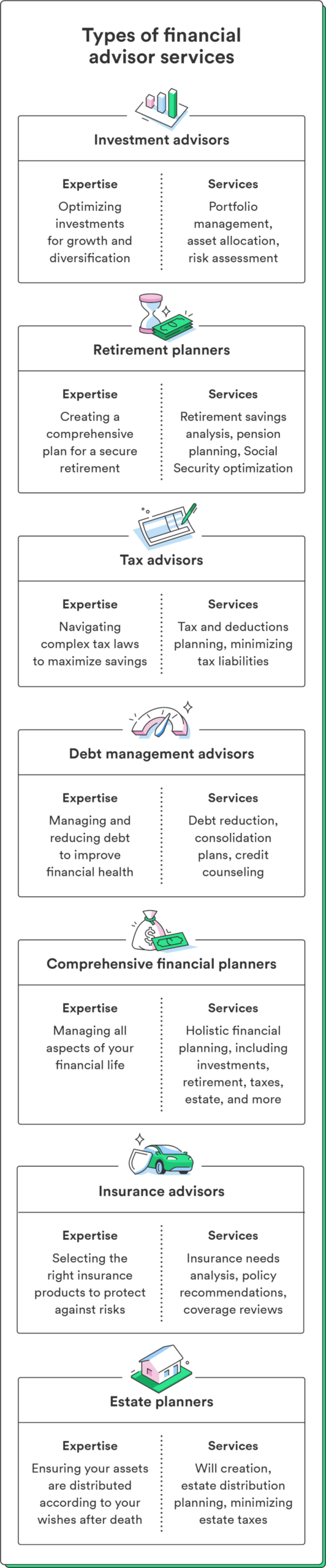

The different types of financial advisors

Seek out a financial advisor who abides by a fiduciary duty, as this implies that they are bound by law to prioritize your best interests.

Financial advisors who do not adhere to a fiduciary standard may possess alternative motivations, such as receiving commissions from the financial products they endorse. These individuals are commonly referred to as commission-based financial advisors, and they are not obligated to prioritize your best interests when making recommendations. It is possible that they may exhibit a preference for financial products like investment funds or insurance policies that provide them with financial benefits.

It is important to note that the term “financial advisor” can be deceptive, as it may not necessarily indicate the individual’s qualifications or credentials. Therefore, when seeking a financial advisor, it is advisable to prioritize tangible credentials. For instance, certifications such as Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA) carry significant value in the industry, showcasing a dedication to ethical standards.

Below is an overview of the various categories of financial advisors:

- Fee-only fiduciary financial advisors are dedicated to prioritizing your best interests. They levy fees for the services they provide and abstain from receiving commissions through the sale of financial products. By doing so, they eliminate any potential conflicts of interest, ensuring that their guidance assists you in attaining your financial objectives.

- Certified financial planners (CFPs) possess a solid educational background in financial planning and are equipped to offer extensive guidance on various aspects such as investments, retirement, taxes, estate planning, and more. These professionals adhere to stringent ethical standards, uphold a fiduciary duty, and commonly operate on a fee-based or fee-only basis.

- Hourly rate advisors: The advisors operate on a fee structure that is determined by the amount of time spent providing advice to clients. This arrangement is particularly beneficial for those who require specialized assistance or guidance on specific financial issues.

- Retainer-based advisors: Retainer-based advisors offer continuous advisory services for which they charge an ongoing fee. This payment structure ensures that clients have access to ongoing advice and support whenever they require it.

The amount you should allocate for a financial advisor is contingent upon your financial requirements and budgetary constraints. If your objective is to establish a modest investment portfolio, a robo-advisor can assist you at a reduced expense compared to an in-person advisor.

5. Compare and vet potential advisors

After determining the specific kind of financial advisor you desire, it is essential to commence your search. Commencing with recommendations from friends, family, or colleagues who have had favorable encounters with advisors can serve as a valuable starting point.

You can also use online databases for finding an advisor, like:

- BrokerCheck: Operated by FINRA, BrokerCheck enables individuals to authenticate the background and qualifications of financial advisors, brokers, and firms. It provides access to details regarding registrations, disciplinary actions, and additional information.

- Investment Adviser Public Disclosure (IAPD): The registration status, services, and any reported disciplinary events for various financial advisors can be verified using the IAPD database. The U.S. Securities and Exchange Commission (SEC) oversees the management of the IAPD.

- The National Association of Personal Financial Advisors (NAPFA): NAPFA serves as a professional organization catering to fee-only financial advisors. Utilize their search tools to locate certified advisors within your vicinity.

- Garrett Planning Network: Garrett Planning Network comprises a distinct assembly of financial advisors and planners who operate on a fee-only basis. By exploring their services and areas of expertise, you can easily locate virtual advisors to cater to your specific needs.

After compiling a list of potential advisors, it is crucial to thoroughly examine their credentials, backgrounds, and fee structures (ensuring they have a fiduciary background). Arrange initial consultations with these advisors to gain insight into their approach, expertise, and style. Ultimately, seek an advisor who possesses the required expertise aligned with your financial goals and values.

15 key questions to ask a financial advisor:

After you have arranged an initial consultation, maximize the value of your meeting by inquiring about the appropriate matters. Provided below is a compilation of questions that will assist you in commencing the discussion:

Fiduciary status and general information:

- Are you a fiduciary?

- What are your credentials and experience?

- What documents and information will you need from me to create a comprehensive financial plan?

Client profile and experience:

- What types of clients do you typically work with?

- Do you have experience assisting clients in situations similar to mine?

Available services:

- What specific financial planning services do you offer?

- Can you explain how these services will address my financial goals?

Compensation and fees:

- How do you get paid for your services?

- Can you provide a breakdown of all the fees I might be charged?

- Are there any minimum account requirements to work with you?

Financial planning style:

- What is your approach to financial planning?

- What is your investment philosophy?

- How will you tailor your approach to my goals?

Meeting frequency:

- How often will we meet to review and adjust my financial plan?

- What’s your preferred mode of communication for ongoing updates?

By carefully crafting these questions, you can guarantee a fruitful meeting and discover the suitable advisor for your needs.